real interest rates and time value of money

is a dollar today worth more than a dollar tomorrow? or a dollar next year?

typically, in a world where people think dollars can earn a risk-free return (usually by investing in government-issued bonds), and where inflation is low and stable, the answer is yes. a dollar today is worth more than a dollar tomorrow, because i can invest it and earn a return over and above the amount that dollar is going to decrease in purchasing power due to inflation.

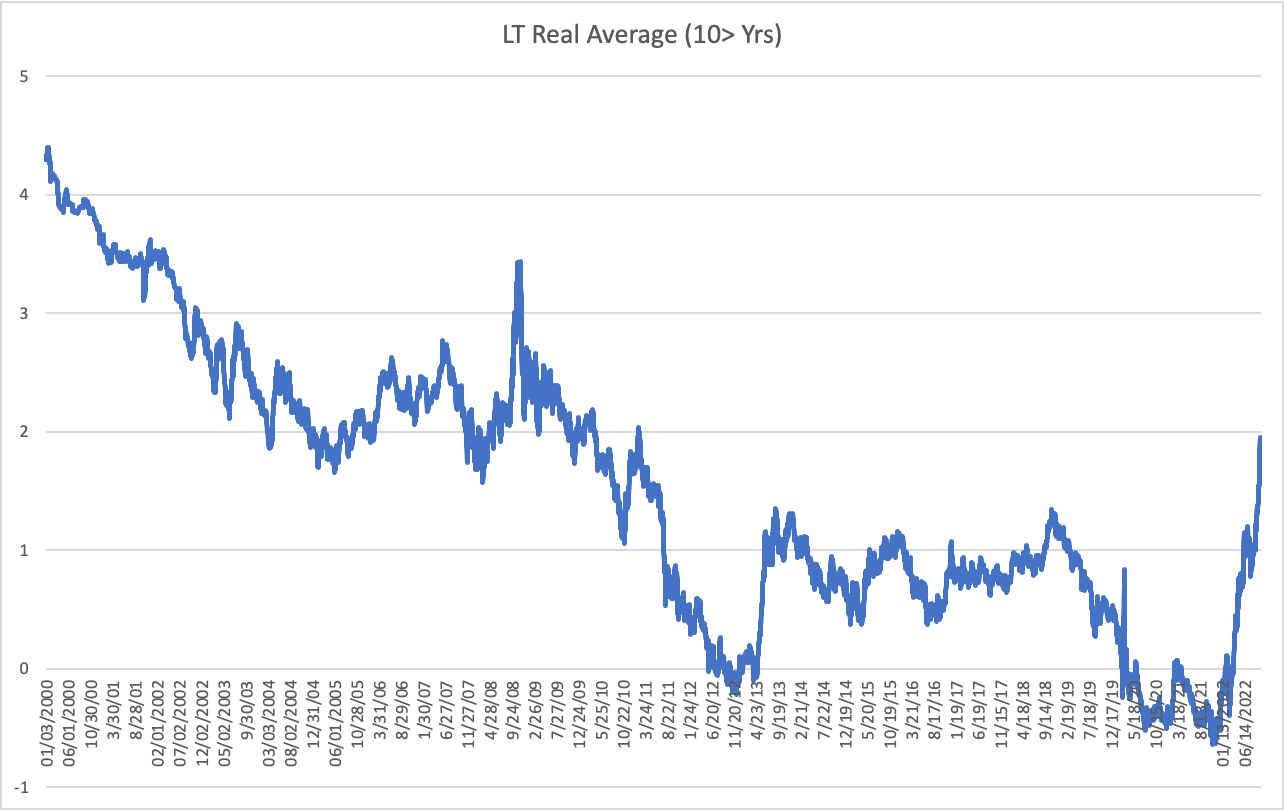

however, we are coming from a paradigm where, given where global central banks had positioned interest rates, the answer was... no.

in fact, in a negative real interest rate environment, which is where we were from april 2020 until april 2022, a dollar today was worth less than a dollar tomorrow. hence the panic and frenzy associated with companies, ideas, stocks, SPACs, and cryptocurrencies that were raising a dollar today to give you theoretically more dollars tomorrow (and each dollar would in turn be worth more!). in an environment like that, there was no sense in hoarding dollars, and each dollar had to stretch to riskier and riskier investments in order to generate a return.

overall, the time value of money depends on

1. interest rates

2. inflation

(1) - (2) is known as the real interest rate. real interest rates are important. (and almost never spoken about)

among all the macroeconomics and market turmoil in recent months something may have actually reverted back to being normal. namely that a dollar today is worth more than a dollar tomorrow.

this means i can now park a dollar with the US treasury, and even after being adjusted for inflation, i can, with a high degree of confidence, practically guarantee myself a real return on my investment.

this is important because all other investments and all other investors must compete with the risk-free rate of return, which is now approaching 2% in real terms and hasn't been this high for more than a decade.

Of course, this does depend on what inflation looks like over the next year. The difference in 5 year US treasuries between nominal (4.1%) and real yields (1.8%) means that investors are betting that inflation will average 2.3% over that period. If you disagree and think inflation will go up, buy some TIPS! (Treasury inflation protected securities). They will rebase and adjust their principal amount to true you up for the purchasing power you lost due to inflation, and deliver a small interest on top besides!